[Free article] Sheinbaum’s biggest challenge, a year in

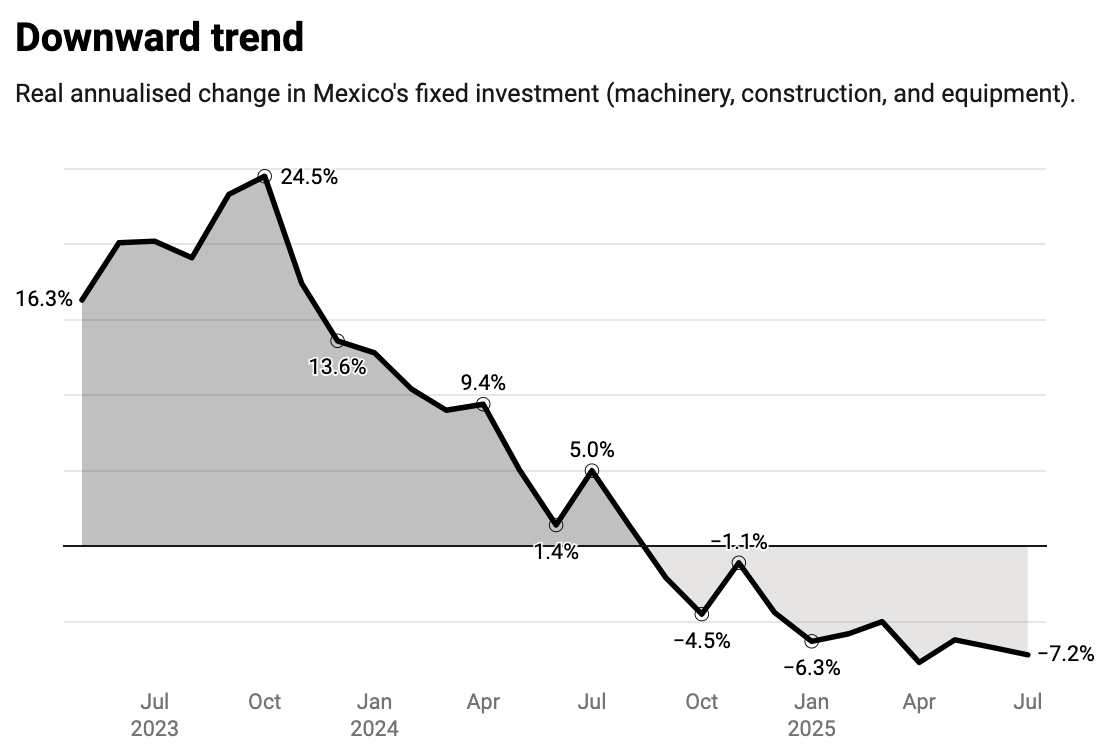

Investment in Mexico’s “real” economy just keeps falling.

The Big News Breakdown. Unpacking this week’s most important news.

Yesterday, president Claudia Sheinbaum celebrated a year in office by touting her government’s main triumphs at a packed Zócalo—Mexico City’s central square. Some achievements are inheritances from her predecessor’s government, including policies that got 13 million people out of poverty.

In other aspects, she has outdone the previous government, namely in security matters. Homicides have gone down significantly since Sheinbaum reached the presidency, though “disappearances” have also gone up—hinting that some of those who previously would have been catalogued as murdered are now considered to be missing. Even so, the decline in murders has been so steep that the tally still winds up in the government’s favour.

There is one indicator that the government cannot polish into good news:

Source: GAEAP

Of course investment in construction, machinery, and equipment isn’t the whole investment story, but it does point at a failure to attract the necessary capital to make Sheinbaum’s industrial strategy work.

In the year since she took office, the government has gone to great lengths to showcase big investments to prove Mexico is a good bet. Yet, many of these hide disappointing truths behind big numbers:

There’s the arrival of data centres said to be worth billions dollars that will not leave even a fraction of that amount in Mexico.

Similar questions arise around the big investments promised by foreign banks, like BBVA and Santander. They have not explained exactly what their large cheques actually mean for the Mexican economy after years of syphoning profits out of the country to subsidise their home operations.

Meanwhile, the fall in investments around manufacturing and construction should ring alarm-bells, both in Mexico and the US—whose trade war with the world has only highlighted the latter’s dependence on its southern neighbour.

As both countries have realised since the rise of China, not all investments are made equal: Some put real money into workers’ pockets; others look great in front of the media but don’t result in much—just ask the Mexican auto industry.

Light at the end of a never ending tunnel

To a certain extent this isn’t Sheinbaum’s fault. She inherited an enormous package of constitutional reforms from her predecessor to which she was beholden and now has to implement. This includes a judicial reform—which worries investors about court impartiality—and a regulatory reform—which turned erstwhile autonomous institutions into government bodies, potentially in breach of USMCA rules.

That leads to worries around Donald Trump.

Despite big concerns just a few weeks ago, worries about a military intervention against cartels in Mexico have significantly diminished. The US government has actually since expressed its pleasure at Mexico’s actions against cartels, including non-Mexican criminal actors, like Venezuela’s Tren de Aragua.

The real worries stem from the as of yet unresolved trade relationship with the US. And it seems that this process of relational re-definitions will take a while to sort itself out. When it comes to trade, even as one crisis is averted, another comes into view. Really, until the ink has dried on the updated regional treaty—the USMCA is set to be reviewed next year—it seems unlikely investors will budge.

These roadblocks to investment are all the more frustrating given that the rest of Mexico’s economic fundamentals—including inflation and its domestic market—are quite strong.

Investors’ unyielding hesitancy is the best proof that, despite this weekend’s celebrations, Mexico cannot afford to rest on its laurels. No matter how high her approval ratings (currently at around 80%) nor how gushing the words of investors at her morning pressers, Sheinbaum still has a long way to go to gain the trust of those whose money she needs to keep her government afloat.